Average Down Payment

Many believe that you must have a 20% down payment when trying to purchase a home. While a larger down payment can help improve home affordability as it will reduce your monthly mortgage payment, coming up with a 20% down payment can prove to be difficult. The median home price in the USA is $419,200 which means that you would have to come up with $83,840 for a 20% down payment. That is a tall ask, especially if you are a first-time homebuyer looking to purchase your first home!

So what is the average down payment in the USA? The overall average down payment in the USA is 18% for the most recent completed year 2024 as reported by the National Association of Realtors. However, to better answer this question, we should take a look at two groups different groups. The first group are first-time homebuyers and the second are repeat homebuyers.

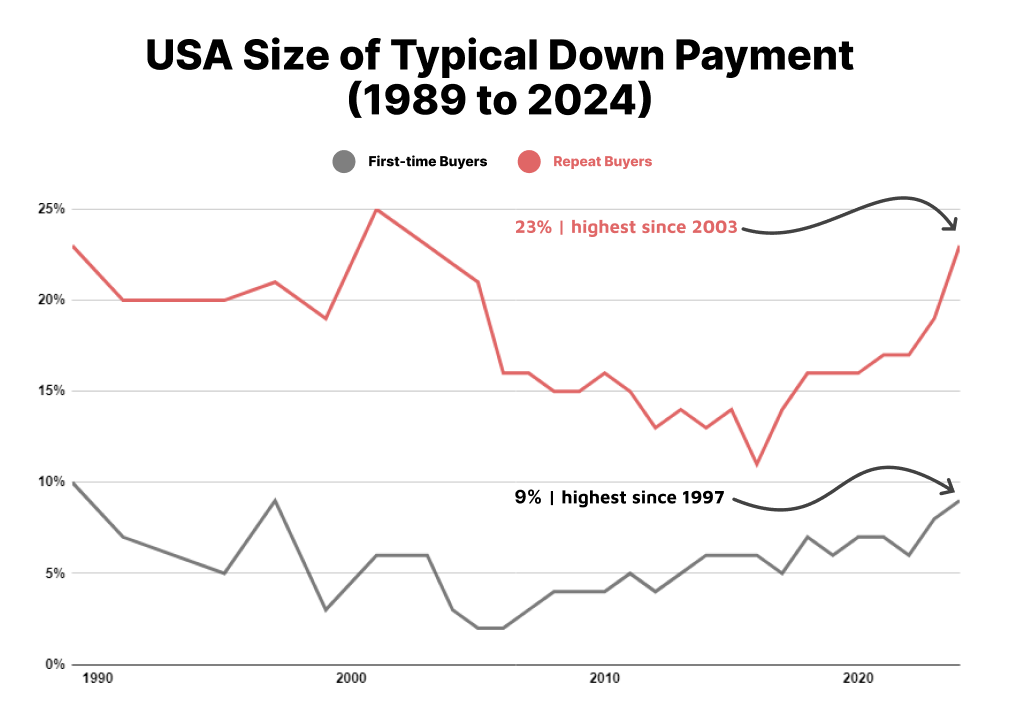

Typical down payment on a house in the USA

This chart breaks down the typical down payment on a house in the USA by both first-time homebuyers as well as repeat homebuyers. It is important to break these two group apart as the overall average is skewed an conveys a different story when both groups are included together. However, we will still talk about the overall average, as when looking at it from the perspective of age groups, it still tells an interesting story.

Average down payment on a house for first-time buyer

The average down payment a first-time homebuyer was 9% in 2024. This down payment percentage is the highest of first-time homebuyers since 1997. As a group, first-time homebuyers are getting older, with the median age of the first-time buyer reaching 38 years old in 2024, up from 35 in 2023.

With the increase in home prices paired with high mortgage rates first-time homebuyers are putting down sizable down payments to decrease thir monthly mortgage payment so it is more affordable. As a result, bot the percentage of down payment has increased, along with the average age of the first time homebuyer.

The first-time homebuyer had an average down payment percentage of 9% in 2024. This is up from 2023 when the average was 8% and 2022 when the average first-time homebuyer down payment was 6%.

What is the average down payment of repeat homebuyers?

Since repeat homebuyers have already owned a home, they have access to equity in their homes which allows them to put down a more sizable down payment. As a result the average down payment of repeat buyers was 23% in 2024. This is a big jump from the average down payment of 19% in 2023 and 17% in 2022. The average down payment for repeat homebuyers in 2024 is the highest since 2003.

Much like the first-time homebuyer, repeat homebuyers are also feeling the pressure and using the size of their down payment to alleviate some of the pressure from high home prices and interest rates. The typical age of the repeat homebuyer also increased by three years as it jumped from 58 in 2023 to 61 in 2024.

Average down payment on a house

The overall average down payment on a home in the USA is 18% for 2024, which is an increase of three percent from the 2023 average down payment amount of 15%. While the average down payment from first-time homebuyers pulls the overall down, there were less first-time homebuyers when compared to repeat buyers. In 2024 the first-time homebuyer share decreased from 32% of home purchases to a historic low of 24%.

Source: NAR