Table of Contents

Key Facts

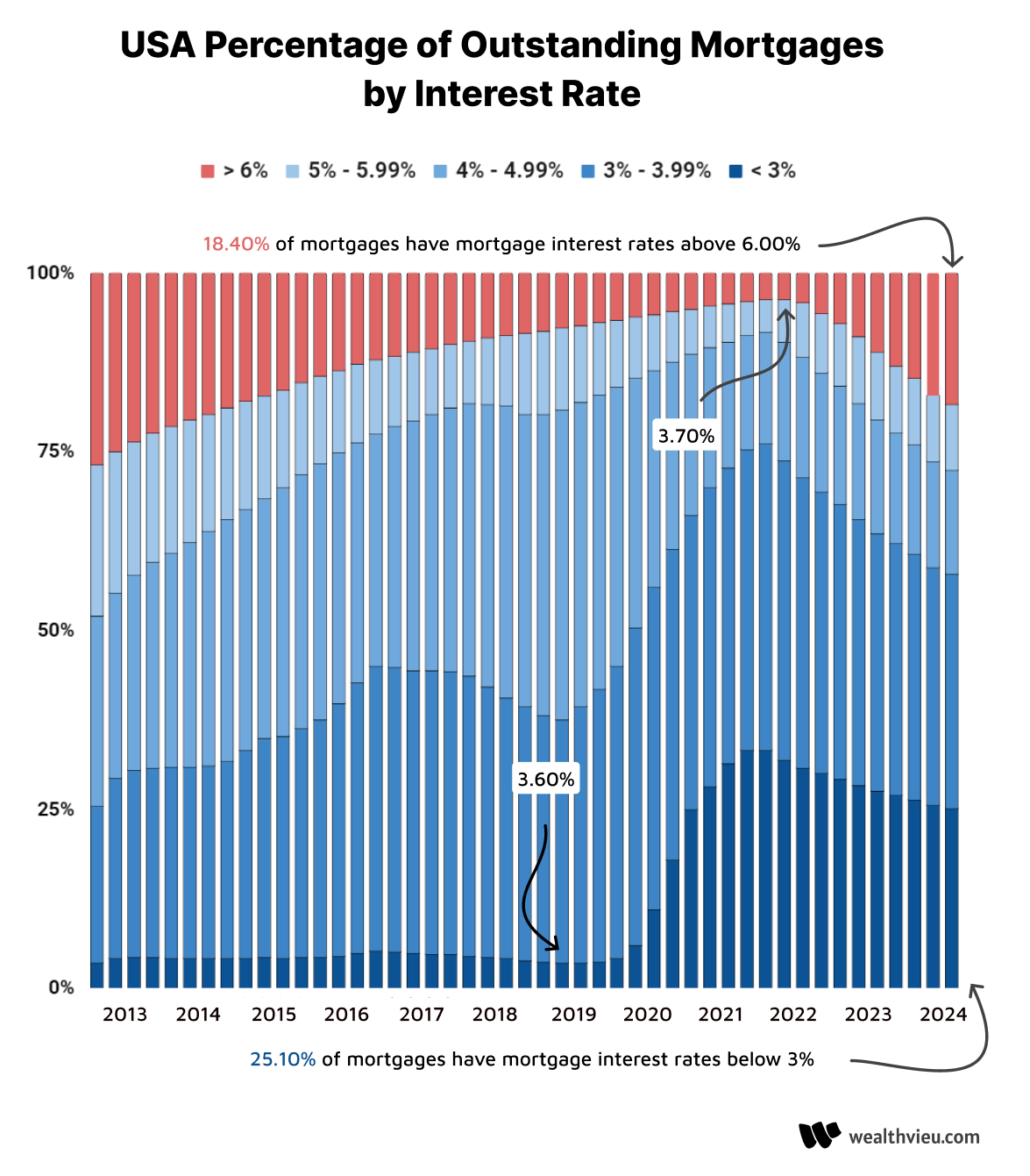

- From 2021 to 2024 the percentage of mortgages with interest rates above 6.00% have increased from 4.00% to 18.40%

- Mortgages with interest rates less than 3% represent 25.10% of all outstanding residential mortgages

- The average mortgage interest rate on all outstanding loans is 4.20%

- The average mortgage payment is $1,869 and the median mortgage payment is $1,606 per month on all outstanding loans

USA current 30-year fixed mortgage rates

The current mortgage rate in the USA as of January 30, 2025 is 6.95%. The average 30-year fixed mortgage rate last increased above 6.00% in Q3 2022 and has remained above 6.00% since then. As a result the outstanding mortgages with a interest rate of 6% or more has grown from 3.70% in Q1 2022 to 18.40% in Q3 2024.

Decline in low-rate mortgages

For those outstanding mortgages with a interest rate of 3% or less the total percentage of loans has been slowly decreasing. In Q4 of 2021 a total of 33.30% of outstanding mortgages had an interest rate that was 3% or less. As of Q3 2024 the percentage of outstanding mortgages with a sub 3% interest rate has decreased to 25.10%.

Growth in high-rate mortgages

While this decrease in the percentage of loans is substantial, it has been decreasing at a slower rate than outstanding mortgages with an interest rate of 6% or more. This is likely due to the mortgage rate lock-in effect in which people are reluctant to sell their home and give up their favorable mortgage rate.

Total mortgages with an interest rates of less than 3.00% have represented 3% to 5% of total outstanding loans over the period of 2013 to the beginning of 2020. As a result of mortgage interest rates decreasing in 2020 many took advantage of the opportunity to refinance their mortgages at the lower rates, in addition to new mortgages locking in lower interest rates.

The 2020 mortgage refinance boom and increase in sub-3% mortgages

From the beginning of 2020 the percentage of sub 3% mortgages rapidly rose from 4.10% of outstanding mortgages in Q12020 to 17.90% of outstanding mortgages in Q42020. An additional year of low interest rates would see sub 3% mortgages jump from 25.00% at the end of Q12021 to a high of 33.30% as of Q42021.

Raising interest rates and the stagnation of sub-3% mortgages

The start of 2022 saw the average 30-year fixed mortgage rate increase above 3% where it peaked later in 2022 at 7.08%. As a result the growth in the percentage of outstanding mortgages stagnated. Mortgage rates have remained above 6.00% in the following years.

Implications for the housing market

Those who were fortunate enough to lock in a sub 3% mortgage rate have been reluctant to move, as doing so even if to a home of the same value would see their monthly mortgage payment jump substantially. However, those who are looking to purchase a home such as first-time homebuyers will have to deal with high interest rates.

We can see the impact by comparing the purchase of homes in these periods of sub 3% mortgage rates vs. increased mortgage rates. In summary someone purchasing the median home in Q42024 would pay $2,772 a month compared to Q42020 where the monthly mortgage payment would have been $1,394 per month.

As of Q3 2024 the median monthly mortgage payment was $1,606 on all outstanding mortgages. This is a result of the combination of high and low interest rates on outstanding mortgages.

Impact of interest rates on homeowners and buyers

The Q4 2024 median home sales price in the USA is $419,200 at the same time the 30-year fixed mortgage rate was 6.85%. The monthly mortgage payment would be $2,772 per month.

The Q4 2020 Median home price was $338,600 was an interest rate of 2.67% in Q4 2020. The monthly mortgage payment would be $1,394 per month.

We can see the impact in the mortgage payment over this period by using the median sales price and 30-year fixed mortgage rate to compare these periods. For other expenses we will use a property tax of $250 per month and homeowners insurance of $50 per month. We will also use a 10% down payment on the median sale price.

Mortgage rates less than 3.00%

- Present: 25.10% in 2024Q3

- Max: 33.30% in 2021Q4

- Min: 3.60% in 2013Q1

Mortgage rates from 3% to 3.99%

- Present: 32.80% in 2024Q3

- Max: 45.00% in 2020Q3

- Min: 21.90% in 2013Q1

Mortgage rates from 4% to 4.99%

- Present: 14.60% in 2024Q3

- Max: 43.40% in 2019Q2

- Min: 14.60% in 2024Q3

Mortgage rates from 5% to 5.99%

- Present: 9.20% in 2024Q3

- Max: 21.20% in 2013Q1

- Min: 4.60% in 2022Q1

Mortgage rates greater than 6.00%

- Present: 18.40% in 2024Q3

- Max: 26.80% in 2013Q1

- Min: 3.70% in 2022Q1

Average interest rate on all outstanding residential mortgages

The average interest rate on all outstanding residential mortgages in the USA is 4.2% as of Q3 2024. This average is based on the contract interest rate at origination of the loan. Of these loans 2.3% are mortgages with adjustable rates which would be impacted by changes in interest rates.

Average monthly payment on all outstanding residential mortgages

The average monthly payment is $1,869 which is a combination of the average principal, interest, and escrow (where applicable). When looking at mortgage data the average tends to be skewed by expensive homes. Therefore, it is important to also consider the median monthly payment which is $1,606 as of Q3 2024.

Average age of outstanding loans

All of the outstanding loans in the USA have an average loan age of 72 months or 6 years. This is the average number of months since the loans origination. The average mark-to-market ltv of outstanding mortgages in the USA is 46.60%. This is the ratio of unpaid principal to the current property value. This means that the average home has 53.40% equity in the home from both payments of principal and increases in property value.

Total mortgage loan value in the USA

There are currently 51.1 million outstanding mortgages with a loan value of $11.9 trillion dollars.

Related: Mortgage Rate Lock-In Effect | Mortgage Affordability Gap | Home Cost to Income Ratio | Average Mortgage Payment

Source: National Mortgage Database (NMDB)