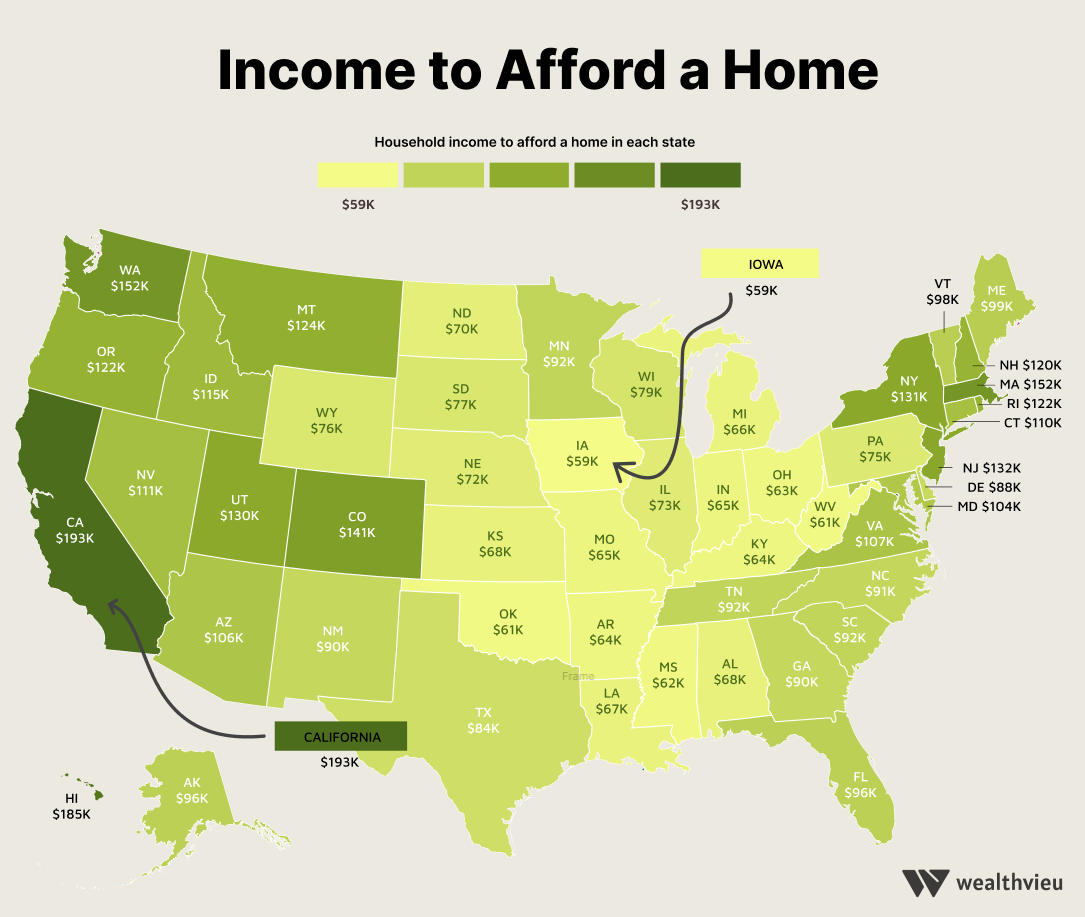

How much household income is needed to afford a home in the US? If you wanted to afford the median priced home it would take household income of $108,522 with the median priced home priced at $419,200.

This income to afford a home is based on a few other factors other than the median home price. A 30-year fixed mortgage rate of 6.87% was used to calculate the mortgage payment. A 20% down payment was used in calculating the monthly mortgage payment. Property tax was calculated as 0.07% of the property value and homeowners insurance as $66 per month. The 28/36 rule of affordability was used to come up with an income that would be able to afford the monthly mortgage payment.

Table of Contents

Household income to afford a home purchase

Purchasing a home has become increasingly expensive with prospective homebuyers now needing to earn at least $100K to afford the median priced home in 21 states.

Here is the income it would take to afford a home on a state-by-state basis:

What impacts home affordability?

Let’s start by answering that question of what makes a home affordable? The general mortgage affordability rule is to not spend more than 28% of your gross monthly income on home costs — these home costs includes the principal, interest, property taxes and insurance.

Following this 28/36 rule you can take your estimated monthly mortgage payment divide it by 28% to see how much gross monthly income you would need to make. Further multiplying this amount by twelve would give you annual income needed for this home to be considered affordability.

Assumptions used in calculating the income in each state

For this calculation we started with the median home price in each state. The mortgage amount was calculated by applying a 20% down payment to the median home price. A 30-year fixed mortgage rate of 6.87% was used which is the current mortgage rate. Since we used the 30-year fixed mortgage rate — it was fitting to use 30 years as the amortization period. PITI was estimated as $66 for homeowners insurance and 0.07% of the property value for property tax.

Calculation breakdown example

You can start with your monthly mortgage payment from a mortgage calculator and then follow the below breakdown to convert it to the annual income needed.

Let’s use the monthly mortgage payment on the median priced home in the US which gives us a monthly payment amount of $2,532 as a starting point.

- Annual Income Needed Calculation Breakdown

- $2,532 monthly mortgage payment

- / 28% (28/36 rule)

- = $9,044 monthly income needed

- x 12 months

- = $108,522 annual income needed

You can also see how much home you can afford by using a mortgage affordability calculator.

What are the most expensive states to purchase a home in?

Hawaii: $212,428

The states that requires the most household income to be considered affordable is Hawaii with a household income of $192,982 for the median priced home to be considered affordable.

California: $197,814

California is the second most expensive states when it comes to income needed to purchase a home. To afford the median priced home of $773,347 it would take household income of $197,814.

Massachusetts: $159,068

Third on the list is Massachusetts with income of $159,068 required to make the median home price affordable.

States with the least income needed to afford a home

West Virginia: $44,036

The least income you would need to afford a median priced home in the US would be $44,036 — which would be to afford the median priced home in West Virginia of $163,434.

Mississippi: $47,564

Mississippi is the second most affordable state with household income of $47,564 needed to afford the median priced home.

Louisiana: $52,493

To afford a home in Louisiana you would need to have a household income of $52,493. This would allow you to comfortably afford the median priced home.

Source: FRED, Zillow