Home prices in the USA have increased from $25,800 in 1971 to $419,200 in 2024. Over this same period of time household income has also increased but at a much slower rate. For this reason when looking at historical home affordability a common ratio is the home price to income ratio. This ratio allows us to see trends in home affordability.

One crutial aspect that the home price to income ratio forgets is the impact that mortgage rates play on the affordability of a home. For this we can take the cost of a mortgage payment throughout the years and compare it to the household income at the time. Comparing mortgage payment allows us to consider the impact of both increasing home price and mortgage rates in comparision to household income.

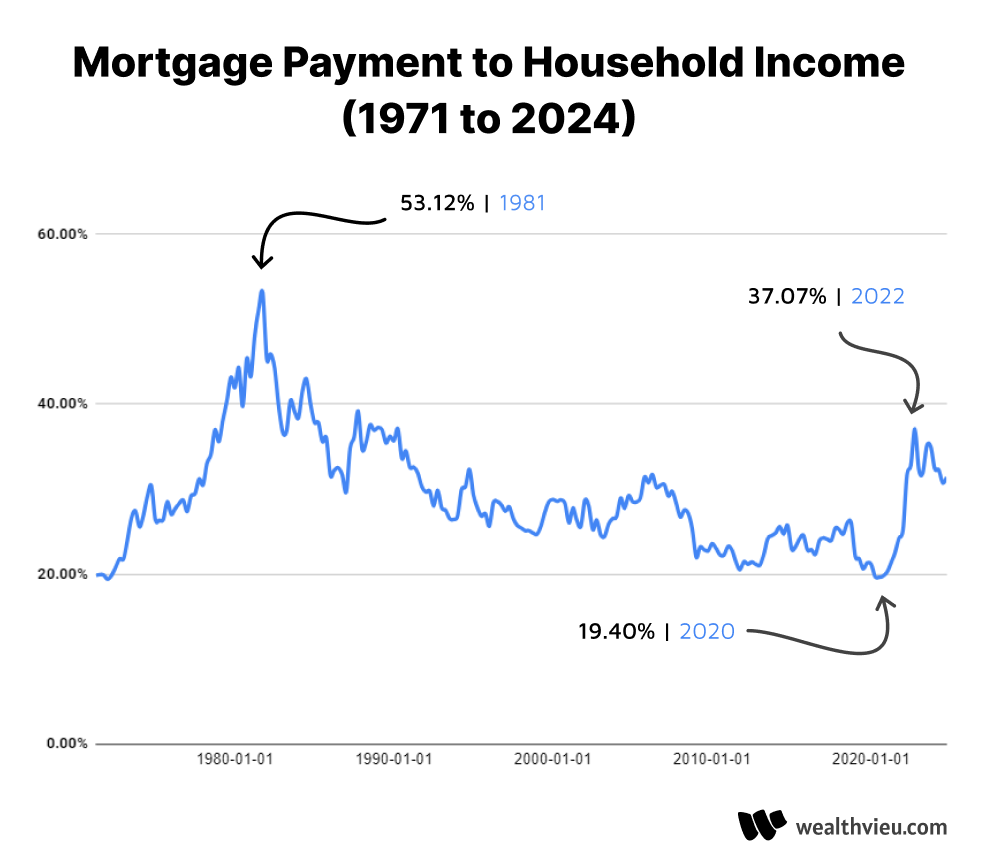

This graph shows a breakdown of the percentage of household income your mortgage payment takes up.

The percentage of household income spent on mortgage payments has had many changes over the years. The most notable periods were in 1981 when it would take 53.12% of household income to cover the mortgage payment. Although the home price at the time was only 3.67 times household income, the 30-year fixed mortgage rate was 17.7% which made affording mortgage payments difficult.

As of 2024 the home price to income ratio is 5.04 with a median home price of $419,200 and household income of $83,100. The average 30-year fixed mortgage rate during this period was 6.60% which translates to a mortgage payment of $2,175 considering a 10% down payment which equates to 31.41% of the median household income.