Canada Prime Rate History

What is the prime rate in Canada?

The current prime rate in Canada is 5.20% as of February 21st, 2025. The prime rate dropped effective January 29, 2025 by 0.25% as the bank of Canada reduced their policy rate by 25 basis points.

The prime rate is the interest rate that banks and lenders use to determine the interest rate for various loans such as mortgages, credit cards and auto loans. The prime rate will impact the rate that you enter into for these financial products. If you choose a variable-rate loan, the prime rate plus a percentage is generally used to calculate your debt payments.

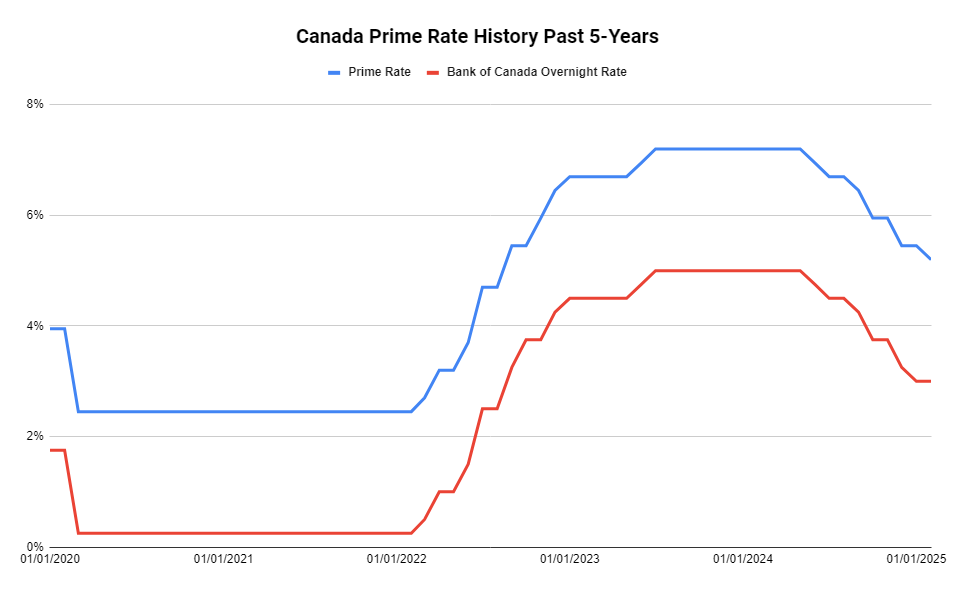

Prime rate changes over the past 5 years

The prime rate in Canada has seen some substantial changes over the past 5-years in Canada. The prime rate was 3.95% at the beginning of 2020 before experiencing three rate cuts of 0.50% to end the year 1.50% lower at a prime rate of 2.45%. The prime rate cut on March 30, 2020 which pushed the prime rate to 2.45% would mark the lowest point the prime rate has seen in the past five years.

The Canada prime rate stayed at 2.45% from March 30, 2020 up until March 3, 2022 almost two years later where the prime rate increased by 0.25% to 2.70. The prime rate continued to increase over the period of March 3, 2022 up until July 12, 2023 where the prime rate reached 7.20%.

The next prime rate change would happen in 2024 where the prime rate would experience a cut of 0.25% pushing the rate to 6.95%. The prime rate experienced a total of five cuts in 2024 where it ended the year at 5.45%. The prime rate then experienced another rate cut of 0.25% in 2025 effective January 29, 2025. The prime rate now sits at 5.20%.

Past 5-year’s of prime rate changes in Canada

The average prime rate in Canada over the past 5-years is 4.62%. The peak prime rate was 7.20% from the period of July 12, 2023 to June 5, 2024. In the past five years the lowest prime rate was 2.45% from March 30, 2020 up until March 3, 2022. The chart below breaks down all of the prime rate changes in Canada over the past five years.

| Effective Date | Prime Rate | Change |

|---|---|---|

| January 29, 2025 | 5.20% | -0.25% |

| December 11, 2024 | 5.45% | -0.50% |

| October 23, 2024 | 5.95% | -0.50% |

| September 4, 2024 | 6.45% | -0.25% |

| July 24, 2024 | 6.70% | -0.25% |

| June 5, 2024 | 6.95% | -0.25% |

| July 12, 2023 | 7.20% | +0.25% |

| June 8, 2023 | 6.95% | +0.25% |

| January 25, 2023 | 6.70% | +0.25% |

| December 8, 2022 | 6.45% | +0.50% |

| October 27, 2022 | 5.95% | +0.50% |

| September 8, 2022 | 5.45% | +0.75% |

| July 14, 2022 | 4.70% | +1.00% |

| June 2, 2022 | 3.70% | +0.50% |

| April 14, 2022 | 3.20% | 0.50% |

| March 3, 2022 | 2.70% | 0.25% |

| March 30, 2020 | 2.45% | -0.50% |

| March 17, 2020 | 2.95% | -0.50% |

| March 5, 2020 | 3.45% | -0.50% |

This rate is impacted when the Bank of Canada raises or lowers the overnight rate.

The historical high for the prime rate is 22.75% in 1981. The historical low for the prime rate in Canada was 2.25% in 2009.

Prime rate at the big 5 banks

These are the current prime rates for the big five banks in Canada:

| Bank | Prime Rate |

|---|---|

| RBC | 5.20% |

| CIBC | 5.20% |

| TD | 5.20% |

| Scotiabank | 5.20% |

| BMO | 5.20% |

Canada prime rate forecast

Some forecasts for the prime rate in Canada in the coming years include:

- 2025: 4.45%–4.70%

Understanding the Prime Rate and Overnight Rate in Canada

The prime rate is set by financial institutions and used as a benchmark for various loans and credit products. This means that changes in the prime rate directly impact variable-rate loans, lines of credit and mortgages.

Where does the overnight rate come into play? The overnight rate also known as the policy interest rate is set by the Bank of Canada which is then used by financial institutions to come up with the prime rate. Since commercial banks make money based on the difference or spread between these two rates, the prime rate is typically higher than that of the policy interest rate.

The policy interest rate, also known as the overnight rate is set by the central bank which is the Bank of Canada which is then used as a base by the commercial banks for lending purposes. Financial institutions set their own prime rate. However, since the prime rate is directly influenced by the Bank of Canada’s overnight rate these rate are often the same across the five major banks in Canada.

Bank of Canada policy interest rate changes

The Bank of Canada has eight fixed annual announcements on policy interest rate decisions which can directly impact the prime rate. At these announcements they provide guidance on any increases, decreases or no change to the policy interest rate. These are the scheduled dates in 2025 for interest rate announcements:

- Wednesday, January 29

- Wednesday, March 12

- Wednesday, April 16

- Wednesday, June 4

- Wednesday, July 30

- Wednesday, September 17

- Wednesday, October 29

- Wednesday, December 10