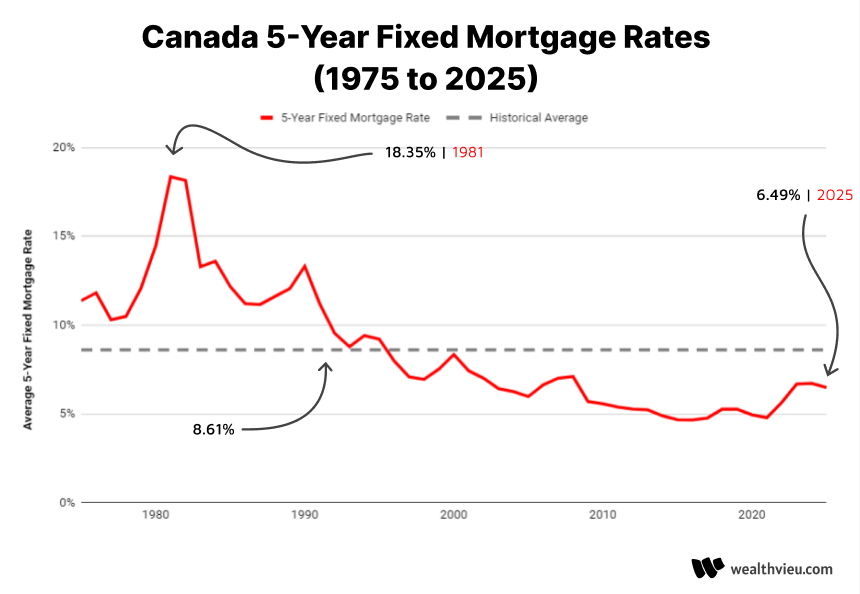

Canada 5-Year Fixed Mortgage Rate History | 1975 to 2025

If you are like many Canadians who purchase a home based on a 25-year amortization period, you will find yourself renewing your mortgage rate many times, especially if you choose the most popular option offered by Canada’s big banks which is the 5-year mortgage rate term. This makes mortgage rates one of the most important factors to consider home affordability in Canada since homeowners will be impacted when they renew their mortgage rate term.

Historical Average Posted 5-Year Mortgage Rates

The average mortgage rate has been tracked since 1975 to 2025 in Canada. Over this period of time the 5-year fixed mortgage rate has an overall average of 8.61%. This high average mortgage rate is a result of a twenty year period from 1975 to 1995 where the 5-year fixed mortgage rate was above 10%.

Highest 5-year fixed mortgage rate in Canadian history

The highest mortgage rate in Canadian history happened in August 1981 where the 5-year fixed mortgage rate reached 21.75%. The overall average for 1981 was also the highest in Canadian history with an average rate of 18.35%.

Lowest 5-year fixed mortgage rate in Canadian history

The lowest 5-year fixed mortgage rate happened in recent years where the 5-year fixed mortgage rate dipped to 2.79% in January 2021. This low 5-year fixed mortgage rate did not stick around long as the overall average 5-year fixed rate for 2021 was 4.79%.

Mortgage rates in Canada

View the mortgage rates around Canada with these pages on specific mortgage rates for each province.