This calculator helps find the amount of tax that applies to sales in Canada with the Goods And Service Tax (GST) / Harmonized Sales Tax (HST) / Provincial Sales Tax (PST).

Sales Tax Calculation

This calculator also allows you to start with the total amount payable after all applicable sales taxes are applied and find the starting base amount.

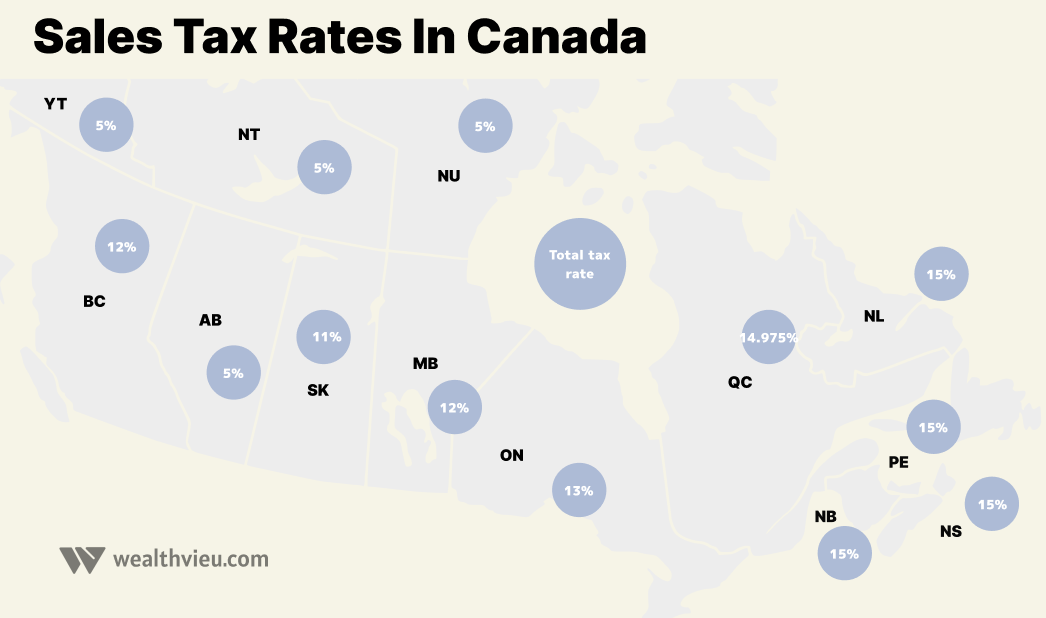

GST/HST/PST rates for each province

This table shows a breakdown of the GST/HST by each province as well as the PST for provinces that do not have HST. It is important to note that these rates will change based on the type of supply, where the supply is made and who the supply is made to.

| Provinces | GST and HST | PST | Total Tax |

|---|---|---|---|

| Alberta | 5% | 0% | 5% |

| British Columbia | 5% | 7% | 12% |

| Manitoba | 5% | 7% | 12% |

| New Brunswick | 15% | N/A | 15% |

| Newfoundland and Labrador | 15% | N/A | 15% |

| Northwest Territories | 5% | 0% | 5% |

| Nova Scotia | 15% | N/A | 15% |

| Nunavut | 5% | 0% | 5% |

| Ontario | 13% | N/A | 13% |

| Quebec | 5% | 9.975% | 14.975% |

| Prince Edward Island | 15% | N/A | 15% |

| Saskatchewan | 5% | 6% | 11% |

| Yukon | 5% | 0% | 5% |

Home

Home